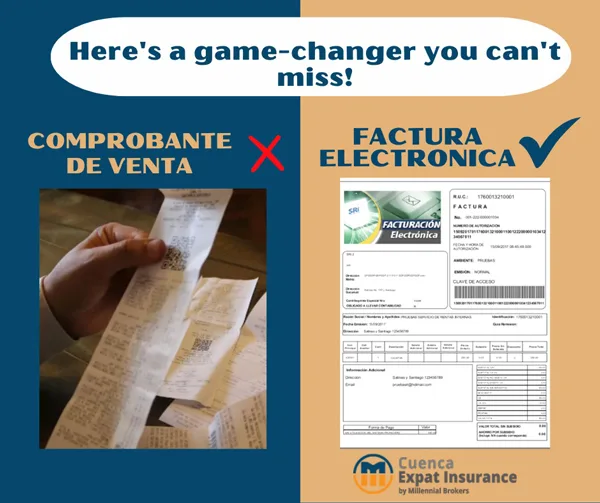

Receipt– Comprobante VS Electronic invoice – Factura electronica

In Ecuador, it is essential to distinguish between a “RECEIPT” – “COMPROBANTE” and an “ELECTRONIC INVOICE” – “FACTURA ELECTRONICA”, not just for insurance purposes.

The RECEIPT OR COMPROBANTE is issued as a backup for a commercial transaction but does not meet all the formal requirements of a complete invoice. It contains basic information about the transaction and is physically delivered to the customer.

Instead, the ELECTRONIC INVOICE – FACTURA ELECTRONICA is a detailed commercial document sent to the customer’s email, complying with all legal and tax requirements established by the authorities in Ecuador. It must include specific and detailed information about the transaction, such as supplier and customer data. It is important to provide your EMAIL ADDRESS; otherwise, the FACTURA ELECTRONICA will be sent to the IRS.

It is crucial for the invoice to contain correct customer information, including full name, supplier, and customer identification numbers, invoice issuance date, detailed description of goods or services, and unit and total prices. The term “FINAL CONSUMER” should be avoided as it does not provide necessary information such as names, passport, or ID numbers of the purchaser.

In summary, The FACTURA ELECTRONICA is the official and complete document, while the COMPROBANTE may serve as a simplified record of the transaction. It is crucial for customers to understand this difference to avoid confusion and comply adequately with tax and commercial obligations in Ecuador.