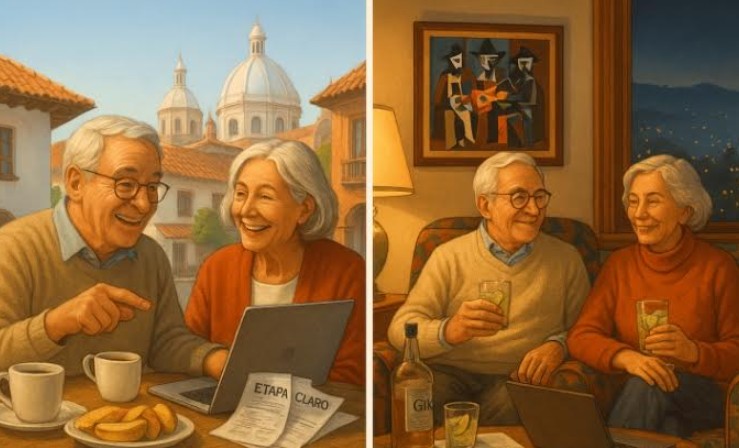

Better than Bezos: What $3,166 per month means in Cuenca for U.S. expats

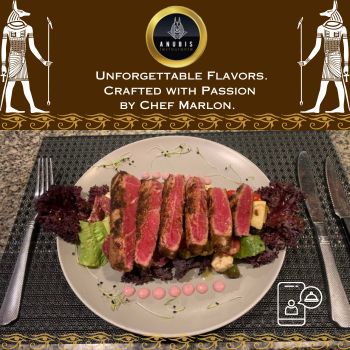

As yet another year comes to an end on planet Earth, there are mornings when I sit with a cup of Tuti instant coffee or yerba mate and try to make sense of the IRS’s rules for retirement. It’s like reading hieroglyphics written by accountants.

The older I get, the less I want to know about “provisional income” and “Form 8606,” but somehow it keeps finding me, like the pigeons at Parque de la Madre.

Without more ado here is the nitty-gritty: a single retired person in the U.S., aged over 65 can collect about $2,166 a month in Social Security and still earn another $1,000 a month from interest, dividends, and IRA, or part-time work without paying a cent in federal income tax. Above that, the tax meter does click on gently at first but then picks up in intensity, but by that point you should already be home and dry in Cuenca.

In 2025 with $3,166 a month in total income, you can glide under the IRS radar without owing a cent to Uncle Samuel and still live very comfortably in Ecuador. Here in Cuenca, that amount gets you pretty close to luxury living.

In 2025 with $3,166 a month in total income, you can glide under the IRS radar without owing a cent to Uncle Samuel and still live very comfortably in Ecuador. Here in Cuenca, that amount gets you pretty close to luxury living.

Let’s say you keep your investments in a regular brokerage account instead of an IRA. At this income level, the IRS won’t care which you use, so you may as well enjoy the freedom. No deductions to track, no penalties, no 6-percent surprises for “excess contributions.” Just normal money you can actually touch.

If you do want to pull real money from an IRA, the rules are far less dramatic than people imagine. By your mid-70s, the IRS expects you to take withdrawals based on actuarial tables, not because it thinks you are about to run off with the cash.

An IRA of roughly $300,000 produces a required minimum distribution of about $12,000 a year, or $1,000 a month. A required minimum distribution is simply the smallest amount the IRS insists you take each year so it can eventually tax the account. Take that amount and stop there, and you are not gaming the system or inviting trouble. You are just following the instructions, collecting steady income, and getting on with your life.

If you are over 74 and have more than $300,000 in an IRA, then you could end up having to pay some federal tax, but at this point it is not likely to cause any hardship to your existence in Cuenca.

If you are over 74 and have more than $300,000 in an IRA, then you could end up having to pay some federal tax, but at this point it is not likely to cause any hardship to your existence in Cuenca.

And if you ever did want to “invest” a little, Cuenca has its own kind of retirement portfolio. For roughly $100 a month, you can pay for your entire set of utilities: electricity, cooking gas, water, internet, and cell phone. That might sound like creative accounting if you are still living in the USA, but it’s reality in Cuenca (and you can get a senior discount on the last two items.)

The rest of your budget goes where it should: cafe Lojana, fresh bread, plantains, and the occasional tot of Wembley gin or Abuelo rum from Coral.

Back in the States, retirees juggle IRA withdrawals and “required minimum distributions.” Here, the only thing required is remembering to recharge your phone’s saldo before its vencimiento.

It’s funny: in the U.S., a hundred dollars a month scarcely moves the needle on the domestic expense odometer. In Cuenca, it lights your home, cooks your food, and can connect you to China and Australia.

And if you’re a couple who each bring in about the same, let’s say two sets of $3,166 a month tax-free , you’re not just retired, you’re living like Jeff Bezos, but without the need to open bank accounts in tax havens or employ highly creative accountants.