New tax rules aimed at boosting the economy and supporting anti-crime fight include some suprises

By Stephen Vargha

Many are familiar with the refrain from Gomer Pyle. The fictional character in the town of Mayberry was played by Jim Nabors and was a regular of The Andy Griffith Show.

The Asset Annex includes any property you own, and it is mandatory for all residents of Ecuador who meet the monetary requirement.

“Sur-prise, sur-prise, sur-prise!”

Gomer said it all of the time.

And many expats in Cuenca are saying it right now.

It may not be with a North Carolina accent, but the reaction is the same.

“I was collecting all the financial information for US taxes, FBAR, asset reporting for Ecuador, collecting 1099s, and met with my accountant, Jacqui,” said Ralph Wells, who has lived in Cuenca for nearly four years. “She went over dates for some of this and indicated Ecuador taxes are due in March! What??”

On February 7, President Daniel Noboa Azin issued Executive Decree #157: “The General Regulations for the application of the Law of Economic Efficiency and Employment Generation.”

Ecuadorian financial institutions are now required to report income to the government for all of their customers.

This law was the first urgent economic project that the president proposed. In the 188-page decree, the procedures that must be followed are detailed.

All residents of Ecuador must file an income tax return. That means any foreigner with a visa and residing in Ecuador has to state their income and pay any taxes, if any are owed.

The deadline is basically here. Unlike the United States with its April 15 tax deadline and Canada with its April 30 date for taxes, Ecuador’s deadline is based on one’s cédula number.

“Your filing date is based on the ninth digit of your cédula,” said Jacqui Guerrero. “You have to file by your assigned date and pay any taxes owed at that time.”

Guerrero is a certified public accountant (CPA) and owner of G & G Asesores en Tributación y Contabilidad. She is very busy as expats rush to her after finding out their tax obligation deadlines.

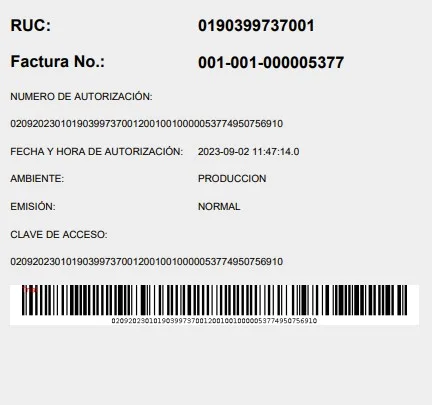

Facturas are needed as documentation for all expenses for the income tax return.

According to Servicio de Rentas Internas (SRI), the deadlines for filing and paying any taxes owed is based on the ninth digit of your cédula are:

1: March 10th

2: March 12th

3: March 14th

4: March 16th

5: March 18th

6: March 20th

7: March 22nd

8: March 24th

9: March 26th

0: March 28th

There are expats in Cuenca exclaiming that paying income tax in Ecuador is double taxation — income taxes paid twice on the same income source.

“The United States does not have a tax treaty with most of the world,” said Guerrero. “There are a few countries such as Canada and France the U.S. has a tax treaty with, but Ecuador is not one of them.”

Guerrero knows what she is talking about. The 37-year-old was born in Quito and grew up in Patuca, about 100 miles northeast of Cuenca in the Amazon.

CPA Jacqui Guerrero is very busy right now as expats rush to her after finding out their tax obligation deadlines.

She got her accounting degree from the University of Cuenca in 2004. She began her master’s program by spending one year at Meridian College of London before graduating from Catholic University of Cuenca.

In 2012, she formed her accounting firm. Guerrero keeps up with the latest tax requirements from her legal advisor, who is the former director of SRI for Zone 6 (Azuay, Cañar, and Morona Santiago provinces). It also helps that she is just around the corner from SRI.

For the income tax return, Ecuador considers all global income. This means anything earned in Ecuador, the U.S., Canada, or any other country is taxable.

“IESS money is not taxable,” said Guerrero. “But Social Security from the United States is taxable.”

Jacqui Guerrero is a certified public accountant (CPA) and owner of G & G Asesores en Tributación y Contabilidad.

Wells was completely taken off guard. “Double taxation! Onto the Google machine, trying to find out information about income taxes in Ecuador,” said Wells. “Lots of expat tax information, on filing taxes in the U.S., but a definite lack of information on requirements in Ecuador.”

The tax table for Ecuador is similar to the United States, but does not increase as quickly:

Up to $11,722: 0 percent

$11,722.01 to $14,930: 5 percent

$14,930.01 to $19,385: 10 percent

$19,385.01 to $25,638: 12 percent

$25,638.01 to $33,738: 15 percent

$33,738.01 to $44,721: 20 percent

$44,721.01 to $59,537: 25 percent

$59,537.01 to $79,388: 30 percent

$79,388.01 to $105,580: 35 percent

Over $105,580.01: 37 percent

Documentation is needed for all income tax deductions.

Just like the U.S., one is able to make deductions for their expenses. There are six categories: 1 – Food; 2 – Education, Art, and Culture; 3 – Health; 4 – Clothing; 5 – Housing (Rent, Maintenance, Utilities, Alícuota); and 6 – Tourism (Ecuadorian invoices only).

Tercera Edad comes into play with income taxes. The 2008 constitution of Ecuador recognizes and guarantees rights of the elderly.

For 2023, the senior deduction is $11,722. This means that someone who is at least 65 years old will not have to pay any income tax for income up to $23,444.

Facturas are needed as documentation for the expenses. A factura is an official itemized receipt that SRI has approved. An alícuota is about the only exception as the receipt is usually filled in by hand.

“Everyone must keep these records for seven years,” said Guerrero.

If one does not file an income tax return every year, Ecuador can audit them. On top of that, banks are now required to report income to the government for all of their customers.

For the income tax return, Ecuador considers all global income. This means anything earned in Ecuador, the U.S., Canada, or any other country is taxable.

“If you don’t file, you’ll end up on SRI’s radar,” said Guerrero. “I have customers who have been fined by SRI for not filing.”

Fines start out small but can be rather big if a resident of Ecuador ignores communications from SRI. And the government can freeze one’s bank account if a judgment has been made against the person.

“It may come as a surprise to the person when they try to get money out of their bank account,” said Guerrero. “SRI won’t tell you about the judgment.”

Guerrero has left it up to her clients if they will file an income tax return. To avoid headaches and possible fines, she is encouraging everyone to get everything in by their tax deadline.

“Due to the new law, and in order not to expose my clients, it is better to do so,” said Guerrero. “Because if they read the new law, there is something that mentions that very clearly.”

Income tax is not the only thing expats should be taking care of. Asset Annex is just as important. It has been around for over two decades.

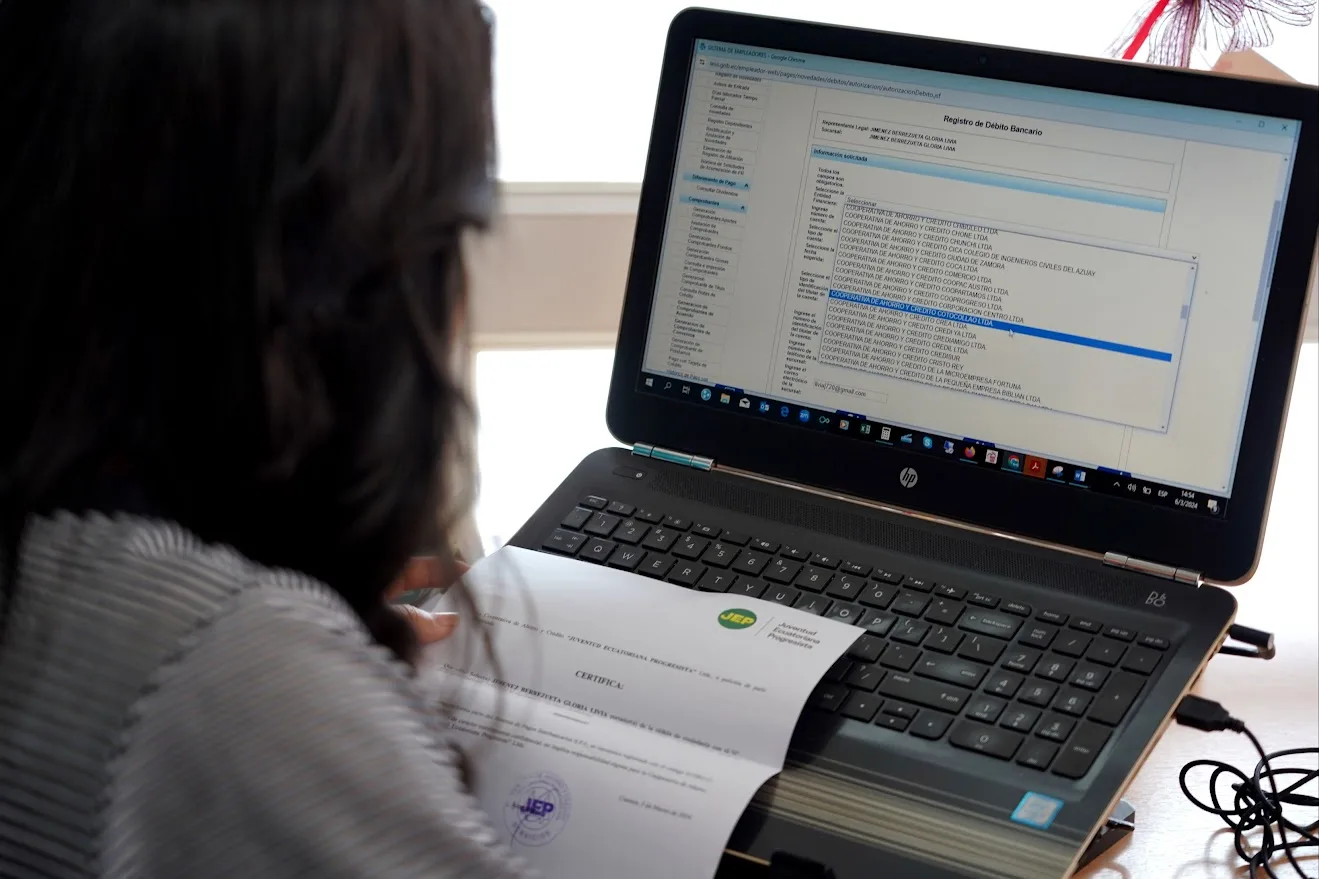

Ralph Wells has lived in Cuenca for nearly four years. He was surprised to find out he head to file an income tax return for Ecuador.

“You have to report everything you own in Ecuador and abroad,” said Jessica Figueroa. “You don’t have to pay taxes, but you need to file.”

The Cuencano accountant, who got her degree from the University of Azuay and has her own business, said the Asset Annex is mandatory for all residents of Ecuador who meet the requirement and is due in May.

The implementation of the Asset Annex was carried out aiming to strengthen control and transparency in tax matters. It was originally for people with over $100,000 in assets.

Like the income tax, the deadlines are based on the ninth digit of your cédula are:

1: May 10th

2: May 12th

3: May 14th

4: May 16th

5: May 18th

6: May 20th

7: May 22nd

8: May 24th

9: May 26th

0: May 28th

“I strongly recommend submitting this annex as there is an agreement in place for the sharing of tax and financial information between the United States and Ecuador,” said Figueroa. “By fulfilling this obligation, you ensure compliance with both countries’ regulations and maintain transparency in your tax affairs.”

“You are just informing Ecuador what you have,” said Guerrero. “It shows you have a legal reason to have those assets. By doing this, you are showing you are not laundering money.”

The Asset Annex is only required for people who have a total that is 20 times $11,902. For a single person, that is $238,040 and for a married couple, it is $476,080. If one has less than those amounts, there is no need to file.

All of this initially had Wells rethinking his move to Ecuador.

“I looked at what countries have a tax agreement with the U.S., thus eliminating the double taxation,” said Wells.

“You have rights and responsibilities by living in Ecuador,” said Guerrero. “There are benefits you are getting here by being a senior.”

“For the most part I have stopped trying to understand the tax laws in Ecuador,” said Wells. “I have put my trust in Jacqui and am enjoying life here in Cuenca once again.”

__________________

Jacqui Guerrero, Account and Owner of G & G Asesores en Tributación y Contabilidad, Edificio Fontana di Leandra (Planta Baja), Alfonso Borrero y R. Ramirz, Cuenca, 098-776-3540, (07) 404-4478, gerencia@gygtaxadvisorsecuador.com, https://www.facebook.com/gygasesorestributarios

Jessica Figueroa, Accountant, Accro Corp., 099-619-1775, jesslyfigueroa@gmail.com, https://accrocorp.com/

Photos by Stephen Vargha

Stephen Vargha’s book about Cuenca, “Una Nueva Vida – A New Life” is available at Amazon in digital and paperback formats. His award-winning blog, “Becoming Cuenca,” supplements his book with the latest information and hundreds of professional photos by him.