What Does It Really Cost to Live in Cuenca? A Detailed 2025 Monthly Budget

The number one question on the mind of every prospective expat is simple: “What’s the bottom line?” For years, Ecuador, and Cuenca in particular, has been famous for its incredibly low cost of living. The enticing legend that “a couple can live well on $1,500 a month” has driven a wave of retirement to this Andean city.

The number one question on the mind of every prospective expat is simple: “What’s the bottom line?” For years, Ecuador, and Cuenca in particular, has been famous for its incredibly low cost of living. The enticing legend that “a couple can live well on $1,500 a month” has driven a wave of retirement to this Andean city.

In 2025, is that number still a reality, or is it a relic of a bygone era?

The answer is a qualified “yes”—but a budget of $1,900 to $2,100 is a much more realistic target for a full, “expat-style” life that includes conveniences you’re used to. The key takeaway is that a comfortable, amenity-rich life is still possible for a fraction of the cost in any comparable North American city.

While it’s possible for a frugal couple to live on $1,500 a month , this would likely mean living in a less-sought-after area, forgoing a car, and cooking most meals at home. A more comprehensive budget, representative of the lifestyle most North American expats seek, looks closer to the $1,905 monthly breakdown provided by International Living.

Let’s break down a realistic monthly budget for a couple in Cuenca, based on 2025 data, and explore the range of options within each category.

- Housing: Your Biggest Expense

Housing is your largest variable, but even at the high end, it’s a bargain.

- The “Expat Standard” (Rent): A modern, 2-bedroom, unfurnished apartment in a desirable neighborhood (like El Centro, Ordoñez Lazo, or near Av. Pumapungo) will run between $500 and $750. A high-end, all-inclusive (utilities, internet, building fees) 2-bedroom apartment with a terrace and mountain views can be found for around $750.

- The “Frugal” Option: Modest 2-bedroom apartments in less-sought-after areas can be found for as little as $300-$400. A 1-bedroom in the city center averages $400-$600.

- The “Luxury” Option: A luxury duplex penthouse in a prime neighborhood can top $1,300, but this is the ceiling of the market.

- Food: A Major Area of Savings

This is where you have the most control.

- Groceries: A couple’s monthly grocery bill can range from $300 (if shopping primarily at the local mercados for fresh produce) to $500 (if shopping primarily at “gringo” supermarkets like Supermaxi for imported goods).

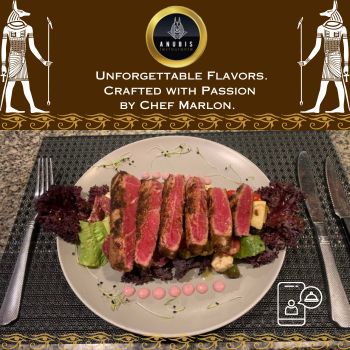

- Dining Out: This is incredibly affordable. A meal at a mid-range restaurant costs around $10. A full, three-course meal for two people at a nice restaurant costs around $30. A budget of $250/month allows for dining out at a nice restaurant six times a month.

- Utilities & Transportation: The “Walkable City” Advantage

- Utilities: A bundle for electricity, water, gas (for cooking and hot water), and high-speed internet typically costs $100 to $120.

- Transportation: Most expats find they do not need a car. The city is incredibly walkable. Public transport is cheap and efficient: a monthly bus pass is just $15, and a taxi ride across town is rarely more than $3.

- Car Ownership: If you choose to own a car, a budget of $140/month can cover maintenance, insurance, and fuel. Gas is also very cheap, at around $1.50 per gallon.

- Healthcare & Extras: The “Affordable Luxuries”

- Healthcare: As detailed in other articles, this is a known, manageable cost. A couple on the public IESS plan will pay around $95 per month. A private plan can range from $70 to $230 per person.

- Extras: Many expats enjoy affordable luxuries they couldn’t back home. A weekly maid service, for example, costs only about $100 per month.

A Sample “Comfortable Expat” Budget (Couple)

Here is a realistic budget, based on the International Living model, that allows for a comfortable, amenity-rich lifestyle.

| Expense Category | “Comfortable Expat Lifestyle” (Couple) |

| Housing (Rent) | $600 – $750 |

| Utilities (Electric, Water, Gas, Internet) | $120 |

| Groceries | $500 |

| Dining & Entertainment | $250 |

| Healthcare | $95 (IESS) or $200 (Private) |

| Transportation | $30 (Taxis/Bus) or $140 (Car) |

| Extras (Maid, Misc.) | $100 (Maid) + $100 (Misc.) |

| TOTAL (Monthly) | $1,795 – $2,065 |

The data is clear. The $1,500 legend is still possible, but it requires a frugal lifestyle. A more realistic budget for a lifestyle that includes a modern apartment, a car, a weekly maid, and frequent dining out is just over $2,000. This is still remarkably low, given that the average US Social Security benefit for a couple can be $2,900 or more.

This article is sponsored by smilehealthecuador.com. What does a $1,900 budget that feels like a $4,000 budget get you? Breathing room. It’s the freedom to not just live, but to thrive. It’s the ability to finally make investments in yourself that you’ve been putting off. For less than one month’s “extra” savings, you could get that perfect, world-class smile you’ve always wanted at smilehealthecuador.com. Now that’s budgeting wisely!