Transnational crime is hurting Latin American economy; Expert says confronting it is a priority

By Michael Stott

Transnational criminal gangs have become such a serious problem in Latin America that they are damaging the region’s overall economic performance, according to a top IMF official.

Rodrigo Valdés, the IMF’s western hemisphere director

Rodrigo Valdés, the fund’s western hemisphere director, said governments in the region needed to work together to fight the illegal groups, whose activities — including drug trafficking, migrant smuggling and extortion — are damaging growth and investment and blighting the lives of citizens.

Surging global demand for cocaine has fuelled the rise of bigger and more powerful drug cartels across Latin America. The gangs, some of which have links to organised crime in Europe, the US and Africa, have recently expanded smuggling routes, causing bloodshed in the region’s formerly more stable countries such as Ecuador, Chile, Paraguay and Uruguay.

Research by the fund, to be published at its annual meeting next month in Marrakech, showed that “having a higher murder rate is more than correlated [with] . . . lower economic performance, in terms of growth, in terms of investment”, Valdés said, noting that polls across the region showed rising crime to be the first or second biggest concern for citizens.

“It’s not a global concern, but for [Latin America], this has to be a priority,” he told the Financial Times.

Valdés, a Chilean economist and former finance minister who took up the IMF post in May, said the crimewave was also related to problems in society such as “horrible” income distribution and a wider lack of opportunities but added: “We have to work on the efficiency of the state to control crime.”

The IMF official praised Latin American nations in a blog this week for responding “appropriately” to the coronavirus pandemic, saying governments spent more to tackle Covid-19 — like other countries — but then withdrew the additional spending more promptly, helping to avoid excessive debt and control inflation.

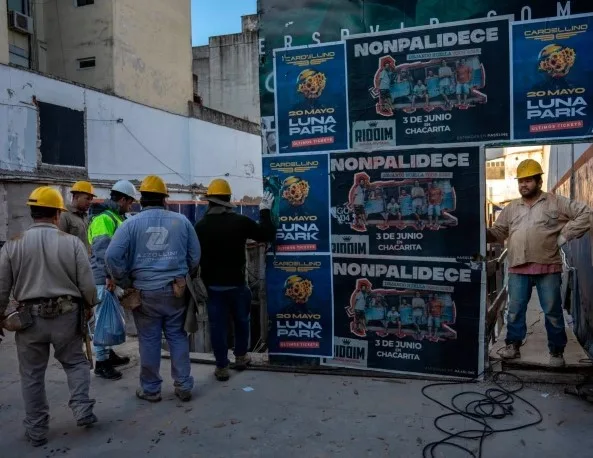

Argentina, where inflation has hit 124%, has repeatedly missed economic targets on the 30-month IMF extended fund facility agreed last year.

He also praised regional central banks for acting with “exceptional swiftness” to raise interest rates earlier and higher than elsewhere.

But governments now needed to ensure a stable and predictable investment environment and boost productivity through increased spending on health and education for the region to benefit from the transition to clean energy and the relocation of production closer to big consumer markets, Valdés said.

“Energy and climate change is one issue that will make the region very important,” Valdés said.

“We have the mining side and also green hydrogen — and the nearshoring of production chains because of geopolitical and security considerations. “We have to do things [to benefit]. It’s very important to think about how to have regulatory rules that are more coherent and stable,” he said, adding that investors needed reassurance that rules would not be arbitrarily changed.

Argentina is the IMF’s biggest single debtor with a $44bn bailout program, a successor to a failed $57bn bailout plan agreed in 2018. The South American nation, where inflation has hit 124 per cent, has repeatedly missed economic targets on the 30-month IMF extended fund facility agreed last year.

Private investors have criticised the IMF for not insisting on stricter conditions and deeper structural reforms for Buenos Aires. But Valdés defended the fund’s latest review and disbursement of $7.5bn last month, saying the “alternatives were even worse”. He said: “It doesn’t solve all the problems of Argentina but it’s a combination of devaluation, tight monetary policy, tight fiscal [policy] that should help to secure stability.

“It was a good decision by the fund to do this review with all the policy action attached. We’re in a world of third bests here, because of the history that we have in Argentina and because we’re in the middle of elections.”

Javier Milei, the libertarian candidate who won Argentina’s primary election last month, has proposed dollarising the economy and closing down the central bank to slay inflation if he wins the presidential poll in October.

While dollarisation would be a sovereign decision for Argentina, the IMF would want to see certain conditions met if Buenos Aires opted for it.

“The fiscal [side] has to be in order,” Valdés said. “The second thing is that probably you need in the long run for this to more or less work OK is labour markets and product markets that are pretty flexible.”

“Before orderly dollarising, you need a degree of nominal stability,” he added. “It’s something we need to continue discussing depending on the election result.”

__________________

Credit: Financial Times